E-way Bill in India: A Complete Guide for Businesses and Transporters

September 26, 2025

AAJ Swift

India produces over seven crore e-way bills monthly. The number of these e-way bills demonstrates the system's integral role in India's Goods and Services Tax (GST) regime. Implemented in 2018, the eway bill system was developed to inject uniformity, transparency, and efficacy into transporting goods over state and national frontiers.

For industries, it has substituted older traditional practices that used to retard logistics and provided avenues for tax evasion. For B2B transport companies, it has lowered check-post delays and facilitated faster clearance. As trade volumes have been increasing consistently, the e-way bill has emerged as a pillar of India's formal economy.

What is an E-way Bill?

An e-way bill is an electronic bill used for the movement of goods worth more than ₹50,000. It has to be generated before transportation. It can be termed a travel permit for goods and is necessary to ensure the observance of GST regulations and provide evidence that tax compliances are fulfilled.

Under the GST regime, the e-way bill is critical. It allows officials to track goods movement in real time, preventing tax evasion. For example, a Surat textile mill dispatching bulk cloth to Delhi can create an e-way bill, generate an entry online, and move goods without any delay at several check-posts. Without this electronic document, the very same truck would have faced fines, holdups, and even the confiscation of goods.

Why is an E-way Bill Important for Businesses and Transporters?

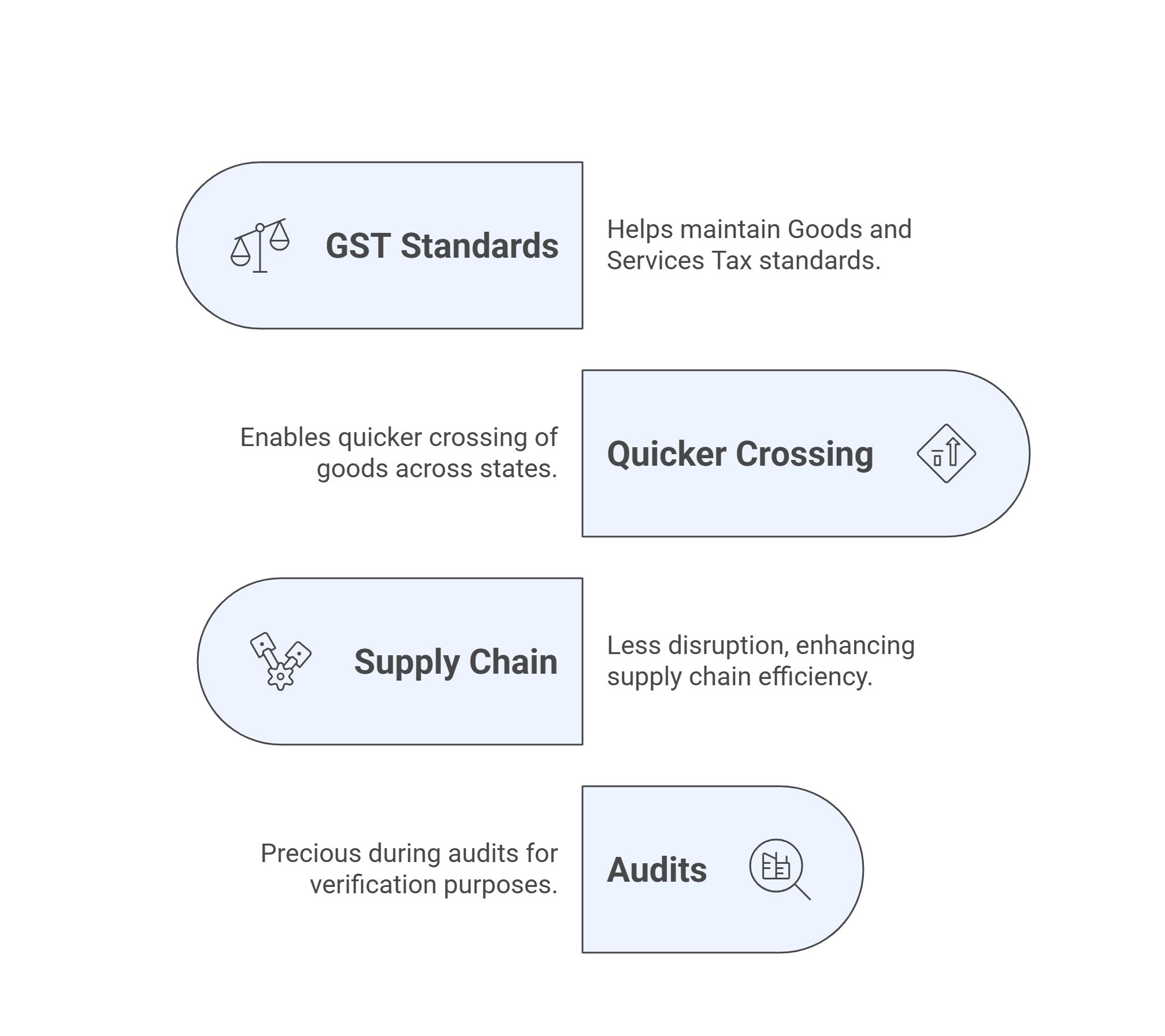

The eway bill system helps to maintain GST standards, one of the main reasons why businesses and B2B transport service providers use it. By requiring e-way bill generation steps online for goods worth over a certain amount, the government has minimized avenues for tax evasion. This secures the economy against revenue loss and reinforces formal trade practice.

The other significant benefit is that it enables quicker crossing of goods across states. Previously, check-posts used to result in delays that would take hours, disrupting delivery timelines and raising transport expenses. With online verification, trucks can now travel with less disruption, enhancing supply chain efficiency.

The e-way bill also reduces logistics bottlenecks and delays, providing for smoother travels. It's beneficial to businesses as well, as digital copies of these bills are precious during audits, allowing them to easily furnish documents as and when needed. For instance, a food-processing industry transporting perishable goods reaps a lot from this speed and certainty since the goods arrive at the destination in time while still fresh.

E-way Bill Rules in India – Key Highlights

E-way Bill Limit

The e-way bill limit requires a bill for any consignment of goods exceeding ₹50,000 in value. Though the threshold remains the same for inter-state transactions, intra-state movement has seen variations being introduced by some states.

Businesses should refer to state-specific regulations to escape penalties. Special rules govern situations where unregistered individuals are selling goods to registered individuals. In such cases, onus can change based on the delivery terms.

E-way Bill Distance and Validity

Validity of an e-way bill is based on the eway bill distance to which goods are likely to travel. The system offers a well-defined guideline, helping transporters plan their route.

If the transit is held up because of breakdowns, strikes, or natural calamities, eway bill validity can be extended. The system provides them with extending the validity and making delivery legally permissible. Extensions have to be requested before expiry, or else fines will be levied.

Who Should Create an E-way Bill?

Different parties are responsible for creating an e-way bill based on the situation. Those registered businesses that ship goods valued above ₹50,000 are required to create the document. In case the supplier is an unregistered person supplying to a registered entity, then it is the responsibility of the registered buyer.

Transporters who move goods through multimodal transport modes such as road, rail, air, or sea might also be responsible for creating the bill if the consignor or the consignee has failed to create it. This allocation of responsibility guarantees accountability along the supply chain.

How to Generate an E-way Bill?

The eway bill generate process is simple and can be done in a matter of minutes on the NIC e-way bill portal. The process is as follows:

- Log in to the official website (ewaybillgst.gov.in) using your GST credentials.

- Provide transaction details, such as invoice number, date, value, and HSN code.

- Input transporter details like vehicle number or transporter ID.

- Enter the details and get an e-way bill number (EBN) of 12 digits.

- Keep a hard or soft copy of the bill during transportation.

Documents Required for E-way Bill

For generating an e-way bill, companies must furnish certain documents. These are:

- Invoice, bill of supply, or delivery challan.

- Vehicle number or Transporter ID in case of road transport.

- For rail, air, or ship: transport document number, transporter ID, and date.

For instance, an exporter of medicines shipping by air must furnish the airway bill number along with e-way bill information to ensure compliance.

E-way Bill Validity and Extension Process

Validity of an e-way bill is directly proportional to eway bill distance. In case of delays in goods due to breakdowns of vehicles, strikes, or natural disasters, the facility to seek an extension online before expiry is available. The procedure is easy, but prompt action is required.

For example, if a machinery-carrying truck breaks down 200 km short of the destination, the transporter can seek an extension for an additional day.

Common Challenges and Mistakes in the E-way Bill System

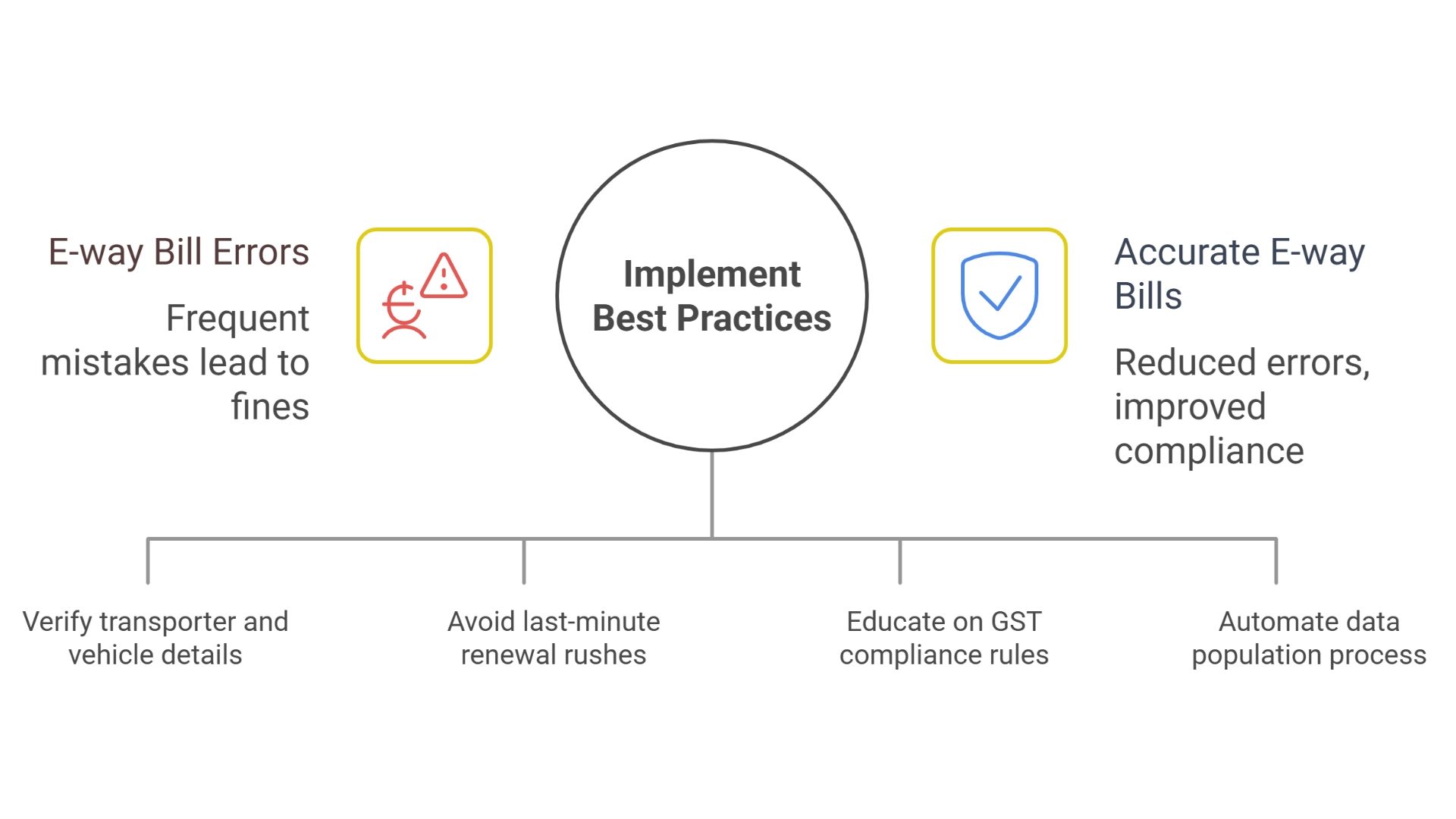

Although it has its benefits, companies at times encounter difficulties. A common error is putting in the wrong vehicle numbers, which can lead to fines if detected during checks. Not renewing eway bill validity is another issue, particularly for multi-destination consignments. Several companies also commit invoice or HSN code mistakes, causing mismatches and non-compliance.

To prevent these errors, companies can follow a few best practices. They can cross-check transporter and vehicle information prior to generating the bill. Reminders for expiry dates avoid last-minute rushes.

Training employees about GST compliance also minimizes the chances of errors. Companies with ERP systems that are integrated with the eway bill system find it much easier to comply, as information is auto-populated and less likely to be incorrect.

Advantages of the E-way Bill System for Business

The eway bill system has brought several advantages beyond compliance. It has minimized paperwork by substituting physical documentation with digital documents. Supply chains have become transparent as each consignment can be traced and authenticated. Speedy clearance at check-posts has eliminated delays, which directly decreases shipping costs.

Another key advantage is enhanced logistics planning. Companies are able to track the movement of goods in real time and change delivery schedules when necessary. This reliability enables them to have good relationships with logistics partners and customers.

Conclusion

The eway bill system has revolutionized the movement of goods within India. By leveraging technology and GST compliance, it has provided transparency, accountability, and efficiency. For transporters and business houses, knowing about the eway bill generate steps, eway bill limit, eway bill distance, and eway bill validity is crucial for smooth operation. Whether it is a small businessman transporting commodities within a state or a big industry shipping exports, the e-way bill continues to be a cornerstone of India's trade infrastructure.