Understanding Transport HSN Codes for Logistics Services: A Simple Guide for Businesses

November 18, 2025

AAJ Swift

Every business that pays or collects GST for logistics should be aware of the right transportation HSN Code. When trucks move from one place to another, challans get stamped, and clients often ask for delivery updates. At such a time, the last thing you need is a notice from the concerned department because you used the wrong code on the freight invoice.

When you use the wrong transport service HSN code, you tend to trigger GST mismatch errors, delayed input tax credit (ITC), and avoidable compliance questions during audits. This blog will walk you through some basics of the Transport HSN Code.

What is a Transportation HSN Code in GST?

A Transport HSN Code defines your transport related service (and it also tells the portal and department which service you submitted and what GST rate to attach to it). In logistics and transport, you regularly come across three headings:

- Heading 9964 - Passenger Transport Services.

- Heading 9965 - Goods Transport Services and Goods Transport Agency (GTA) services.

- Heading 9967 - Supporting Services in Transport: Cargo Handling, Warehousing and Storage.

In short, the transport HSN code and GST rate are linked, or two sides of the same coin. Choose the right code, and the rate usually falls into place automatically.

Understanding the Transport HSN Code

Here are some things that you should know regarding the Transport HSN Code.

1. Classification of transport services under GST

Before selecting a code, you need to know how GST looks at transport:

- Passenger transport.

- Transport of goods.

- Supporting or auxiliary services (warehousing, cargo handling, port services).

- Postal and courier services.

Each of these buckets has a different transport service HSN code range. The exact choice depends on what you are billing for on that invoice line.

2. Common HSN codes used in transportation

Here is a simple snapshot of commonly used codes and rates. These are typical scenarios and not a substitute for checking the latest notifications.

HSN Code for Transportation Charges in Different Scenarios

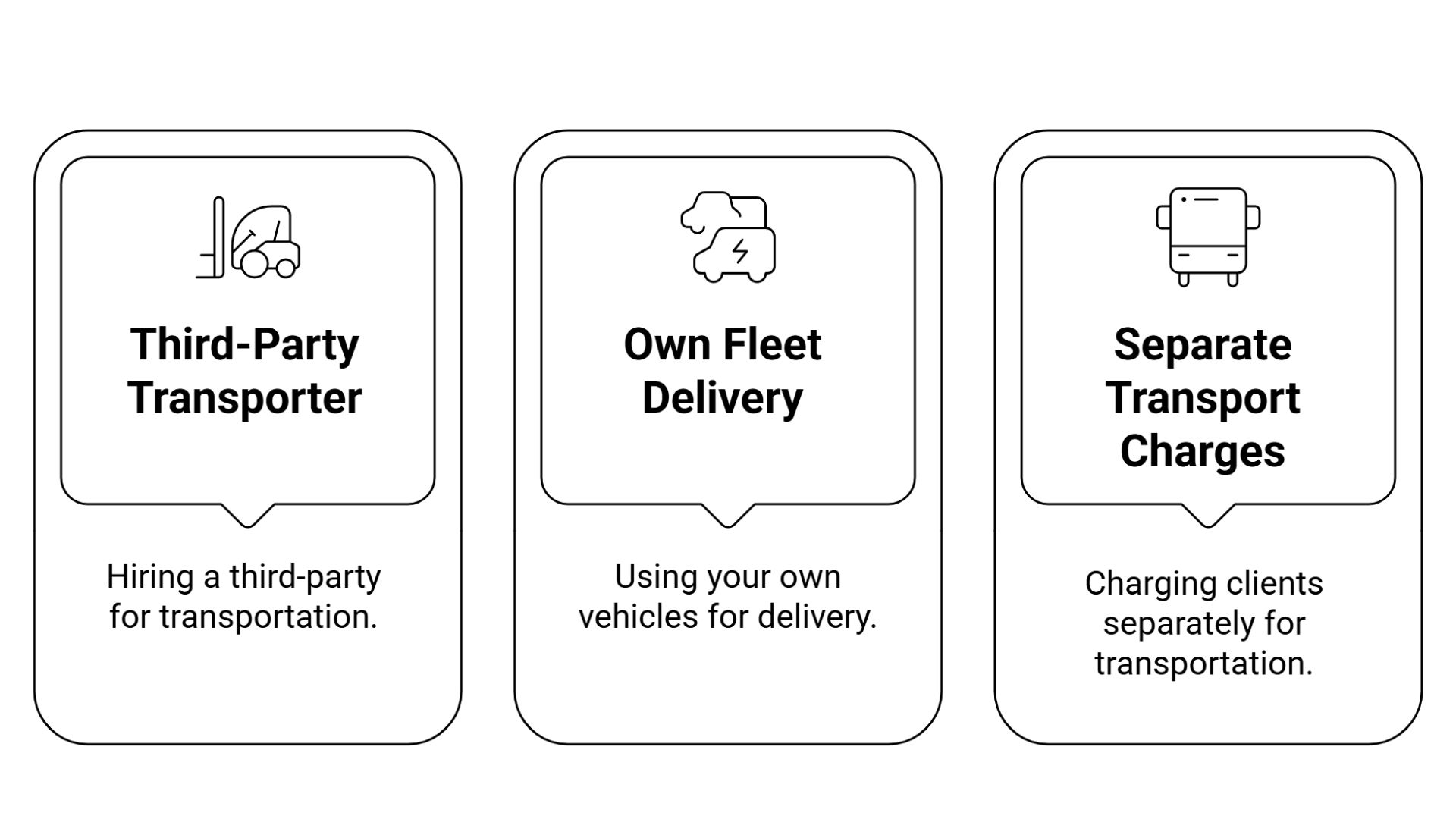

Here is how the HSN code for transportation charges typically changes with the situation.

1. When You Hire a GTA (Third-Party Transporter)

If you outsource B2B transportation to a registered Goods Transport Agency (GTA) that issues a consignment note. In that case, the service is generally classified under Service Accounting Code (SAC) 9965, which covers goods transport services. On their invoice, the transporter will normally use HSN code 9965 for transportation charges and charge GST at 5% or 12%.

2. When you use your own fleet for delivery

If you are a manufacturer or a trader delivering goods in your own truck without issuing a consignment note in the GTA sense, you are exempt from GST. Even when the rate is nil, some businesses still prefer to show the correct code, such as 9965, as their transportation HSN Code for clarity and audit trail.

3. When you charge clients for transport separately

If you are a logistics company providing end-to-end cargo movement, the transport charges HSN code will be 9965 or 9968, depending on whether you operate as a GTA or a courier/express service. In these cases, you are supplying your own service to the client. So the transport HSN code and GST rate must match what you actually do, not what appears on the vendor bill that you pass on.

How to Find the Right Transport HSN Code

If you have any doubts about the right transport service HSN code, just try to follow these steps:

1. Identify if the Service is Goods or Passenger Transport

Start by asking a basic question, like, "What did you move?" Depending on the answer, the code would be Heading 9964 for passenger movement and 9965 for Goods movement. This simple question can reduce your headache by half.

2. Check Whether it is GTA, Courier, or Something Else

Now, if it's a goods transport, you should find out if someone issued a consignment note and act as a B2B Transport company. In other words, you are mapping each invoice line to a business reality and then to a Transportation HSN Code.

3. Use the CBIC HSN/SAC Lookup and GST Portal

If you have the classification you need, you can search it in the CBIC list of service rate notifications and classification for Chapter 99, or use the HSN/SAC search utilities that mirror the CBIC master code. These tools show the official description, the code structure, and the notified GST rate. This is the safest place to confirm your transport HSN code and GST rate combination.

4. Verify the GST Rate

After choosing a code, always cross-check if the service is exempt, nil-rated, or taxable. If it's taxable, check whether it has two other rates with conditions, and whether reverse charges apply for these B2B logistics services.

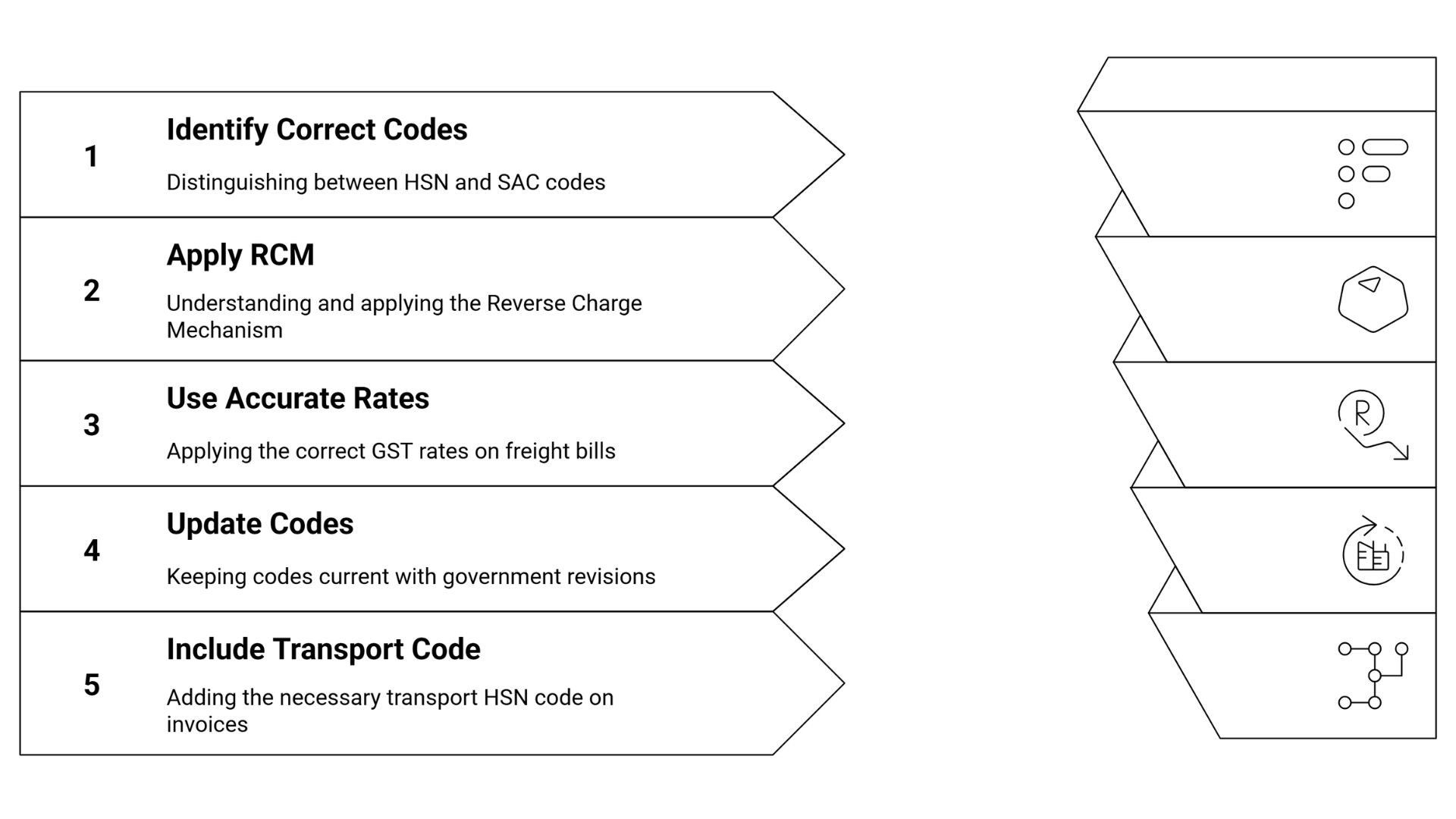

Common Mistakes to Avoid

Here are mistakes that frequently show up in real GST audits and departmental queries.

1. Using Goods-Related HSN Codes Instead of Service SAC

Transporters often use the same HSN as the goods being moved, for example, the chapter for machinery or chemicals, instead of the appropriate HSN code for transportation charges under 9965 or 9967. This distorts the GST rate, confuses recipients, and may block ITC.

2. Ignoring the Reverse Charge Mechanism (RCM)

GTA services are well known for reverse charge complications. If the law says the recipient must pay GST under RCM, but the supplier charges GST under a courier charge with a random transportation HSN Code, both parties end up in a grey area. This is why understanding whether your transaction qualifies as GTA is essential.

3. Applying the Wrong GST Rate on Freight Bills

Because freight is often a small percentage of the invoice value, some teams do not worry about whether it should be 0%, 5%, 12%, or 18%. Over time, though, this can become a serious issue when an officer scrutinizes your reconciliation of the transport HSN code and GST rate.

4. Not Updating Codes After Government Rate Revisions

GST rates, especially on logistics- and energy-related transport, have been revised and clarified over the years. If you still rely on a three-year-old spreadsheet for your transport charges, HSN code, and rates, it is now out of date.

5. Missing Transport HSN Code on Invoices

Sometimes the description reads "Freight" or "Delivery" but the HSN/SAC column is blank. This looks like a small formatting issue, but at large volumes, it can lead to ITC being questioned, especially when your customer wants to prove eligibility based on the correct transport service HSN code being printed on the document.

Why Using the Correct Transport HSN Code Matters

Getting the Transportation HSN Code right is not just an academic exercise.

- Prevents penalties and eases audits: When your codes match CBIC descriptions and GST rates, an officer reviewing your books sees a familiar structure. This reduces the risk of disputes, show-cause notices, or lengthy clarifications later.

- Protects input tax credit: Your customer's ITC often rides on your invoice quality. If their freight ITC is denied because you used a product code instead of the correct HSN code for transportation charges, it directly affects your commercial relationship.

- Supports automation in ERP and billing systems: Once you standardize transport HSN codes and GST rate combinations in your ERP or TMS, your team can raise thousands of invoices with minimal manual checking.

- Improves transparency with clients and vendors: A clear description with the right transport service HSN code shows clients that you understand GST and are not casually throwing around freight figures.

Conclusion

Transport looks simple on paper. One truck, one consignment, one freight amount. In reality, that single amount can fall under several different headings depending on who is responsible, how the PTL transport service is structured, and what kind of business you run. Once you have a basic discipline in place, choosing the right HSN code for transportation charges becomes a routine step instead of a source of anxiety.